Rinse-and-repeat trading abuses is where a trader capitalizes on the wide spread of a stock.

For example: $WPI .87 bid, .91 offer — a trader just buys and sells repeatedly in the virtual trading platform and takes advantage of the illiquid stock and its wide spread.

In the real markets, you can barely trade these situations because you need to queue your volume. Meaning, you run the risk of not having your order filled since the stock is barely trading, or much worse, you could be trapped in an illiquid stock.

On the other hand, in any virtual trading system, anyone can just go maximum allocation and buy/sell repeatedly since there is no queue, and you can exit any time — which does not represent real markets. In real market situations, you won’t be able to trade this consistently with significant volume, which is why we do not find this strategy as realistic

This kind of stock behavior depicts an unrealistic strategy and it is often abuse-able in virtual trading competitions.

We understand that scalping is a form of strategy, but it is barely applicable in the Philippines especially given the high commissions and the inability to go-in-and-out consistently due to the lack of liquidity and risk of wide spread stocks that suddenly become inactive and illiquid. Day-trading stocks that have real moves and liquidity are OK, but those who are just looking to repeatedly abuse stocks that are barely trading (widespreads) and are illiquid will be DISQUALIFIED.

As we have said, we will have no TOLERANCE to traders who are abusing illiquid stocks and rinse-repeat abuses.

We have observed that there are still a lot of traders mainly profiting from illiquid stocks and repeatedly doing rinse and repeat strategies. We have given our warning earlier to some of you. Our algorithms and our team has detected several players who continue to abuse and rely mainly on ‘rinse-repeat’ spread abuse trades. We have been very consistent in iterating to you that RINSE-REPEAT, unrealistic and abusive trading strategies will be penalized and will not be TOLERATED in this competition.

What are “abusive” trades?

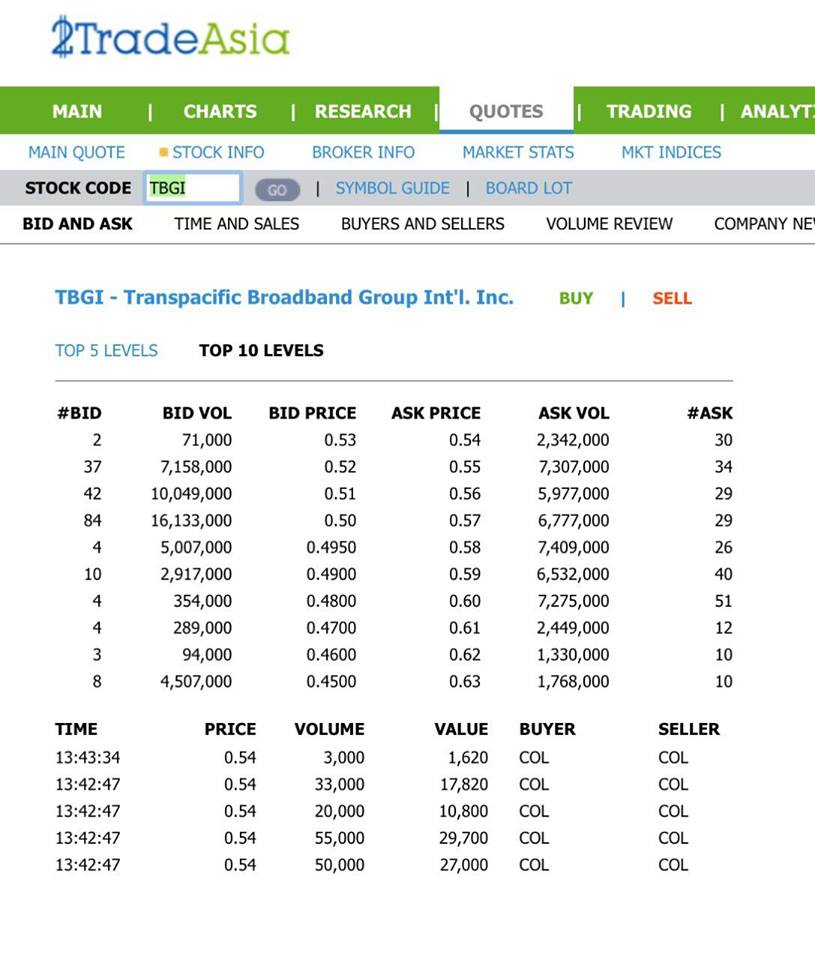

Example 1: TBGI

Look at the Bid and Ask Table Below.

Some of the Traders may Opt to Buy the Stock (in the Competition) at 0.53, Sell it at 0.54 and in just a few minutes, gain around 1.5+% in profits per trade. This is nearly impossible and takes a huge amount of Time once done in Real Life because you have to wait for your order to be filled first.